A well-structured short-term investment portfolio is essential for individuals looking to preserve capital while earning steady returns over a short period. Short-term investments typically range from a few months to five years, offering liquidity, low-risk exposure, and quick access to funds. By diversifying your short-term portfolio, you can balance risk and returns while ensuring financial security.

If you’re looking for short-term investment plans, building a diversified portfolio can help maximize gains while protecting your capital.

Why Diversify Your Short-Term Investment Portfolio?

- Reduces Risk: Investing in multiple asset classes ensures that losses in one segment are offset by gains in another.

- Optimizes Returns: Diversification helps balance high-risk and low-risk investments to maximize short-term returns.

- Provides Liquidity: A diversified portfolio includes investments with different maturity periods, ensuring funds are available when needed.

- Capital Preservation: Many short-term investments focus on capital safety while generating moderate growth.

Key Components of a Diversified Short-Term Investment Portfolio

1. Fixed Deposits (FDs) – The Foundation of Stability

Fixed deposits (FDs) are a low-risk investment that provides guaranteed returns over a fixed tenure. They are a fundamental part of a short-term portfolio for those who prioritize capital preservation.

Why Choose FDs?

- Guaranteed returns with interest rates ranging from 5% to 7.5% per annum.

- Flexible tenure options from 7 days to 5 years.

- Senior citizens get additional interest benefits.

- Liquidity through premature withdrawal (with penalties).

2. Liquid Funds – High Liquidity with Market-Linked Returns

Liquid funds are mutual funds that invest in short-term money market instruments, offering higher returns than savings accounts while ensuring easy access to funds.

Why Choose Liquid Funds?

- Instant redemption (within 24 hours).

- Returns between 3% to 6% per annum.

- Ideal for emergency fund allocation.

- No exit load if held for more than seven days.

3. Recurring Deposits (RDs) – Systematic Savings with Assured Returns

Recurring deposits help investors save consistently by depositing a fixed amount monthly. RDs are perfect for individuals who want disciplined savings while earning fixed returns.

Why Choose RDs?

- Interest rates range from 5.5% to 6.5% per annum.

- Suitable for investors with low risk tolerance.

- Tenure options between 6 months to 10 years.

4. Short-Term Debt Mutual Funds – Moderate Risk with Higher Returns

Debt mutual funds invest in fixed-income securities like government and corporate bonds, treasury bills, and money market instruments. These funds offer better returns than fixed deposits with relatively lower risk.

Why Choose Short-Term Debt Funds?

- Returns between 5% to 8% per annum.

- Short duration reduces interest rate risks.

- Suitable for investors looking for higher-than-FD returns with moderate risk.

5. Treasury Bills (T-Bills) – Government-Backed Security

T-Bills are short-term government-backed securities that provide secure returns within 91, 182, or 364 days.

Why Choose T-Bills?

- Zero risk since they are issued by the Indian government.

- Highly liquid with attractive returns.

- Ideal for investors looking for short-term capital preservation.

6. Post Office Time Deposits – Reliable and Government-Backed

Post Office Time Deposits (POTD) offer a fixed interest rate and capital security. It is an excellent option for risk-averse investors.

Why Choose POTD?

- Interest rates range from 5.5% to 6.7% per annum.

- Lock-in periods of 1, 2, 3, and 5 years.

- Tax benefits under Section 80C for 5-year deposits.

7. Corporate Fixed Deposits – Higher Returns with Moderate Risk

Corporate fixed deposits are offered by non-banking financial companies (NBFCs) and corporations, providing higher interest rates than traditional bank FDs.

Why Choose Corporate FDs?

- Returns between 7% to 9% per annum.

- Lock-in period between 1 to 5 years.

- Slightly higher risk compared to bank FDs.

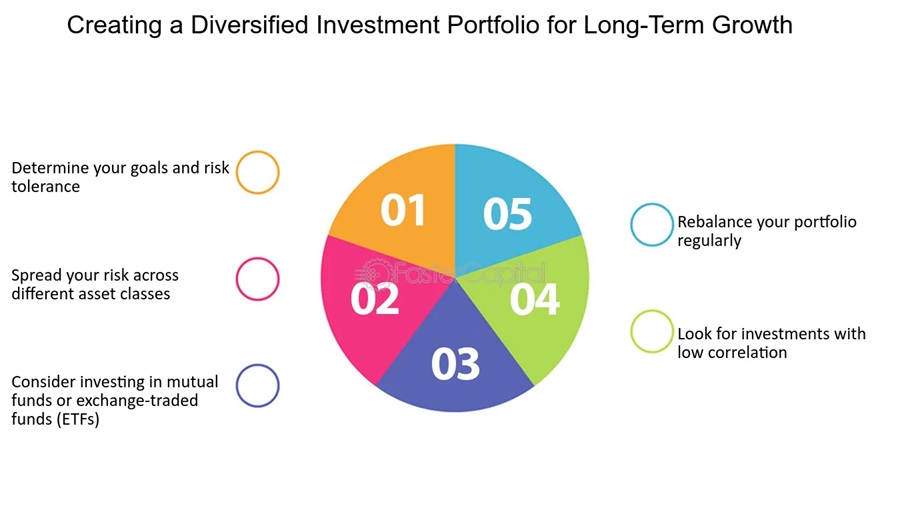

How to Build a Diversified Short-Term Investment Portfolio?

1. Define Your Investment Horizon

Determine how long you can invest your money—short-term plans typically range between 3 months to 5 years.

2. Balance Risk and Returns

A combination of low-risk (FDs, RDs, T-Bills) and moderate-risk (debt mutual funds, corporate FDs) investments ensures stable returns while limiting exposure to market volatility.

3. Prioritize Liquidity

Including liquid funds and short-term debt instruments ensures that you have readily available cash for unforeseen expenses.

4. Consider Tax Implications

Certain investment plans like FDs, RDs, and corporate FDs are subject to TDS (Tax Deducted at Source), while debt funds and T-Bills have capital gains tax implications. Understanding these tax aspects helps in optimizing net returns.

5. Regularly Review and Rebalance Portfolio

Market conditions, interest rates, and personal financial goals may change. Reviewing your portfolio periodically ensures that your short-term investment strategy remains aligned with your needs.

Who Should Invest in a Diversified Short-Term Investment Portfolio?

- Salaried Individuals: To save and earn steady returns for immediate goals.

- Entrepreneurs & Business Owners: To manage cash flow efficiently while keeping funds liquid.

- Retirees: To earn fixed returns with low-risk investments.

- Young Professionals: To build an emergency fund and save for short-term expenses.

- Investors Seeking Stability: To balance risk and return with short-term, diversified assets.

Final Thoughts: Choosing the Best Short-Term Investment Policy

Building a diversified short-term investment plan helps in optimizing returns, ensuring capital protection, and maintaining liquidity.

If you’re looking for the best investment policy in India, diversifying across fixed deposits, mutual funds, and government-backed instruments ensures a stable financial portfolio. By assessing your financial goals, liquidity needs, and risk tolerance, you can create a robust short-term investment strategy to achieve financial success.